May – Don’t go away just yet

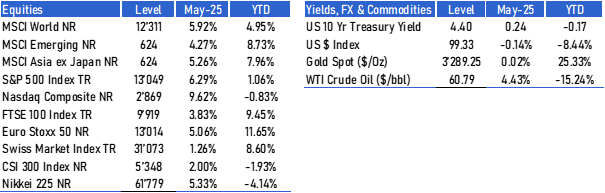

During the month of May, all conventional wisdom went out the window. Indeed, history taught us that stock markets do not like trade wars (remember the 2018-2020 US-China trade war?). And all economic theories indicate that this trade war is damaging. Yet, in this US vs the world trade war of a magnitude that dwarves the previous one, markets are significantly up. Despite a couple of short-lived scares, we witnessed a significant rebound in equity markets. Even US indices, which were deep into negative territory on a year-to-date basis are back in positive, with the exception of the Nasdaq, which despite performing 9.6% in May remains at -0.83% so far this year and Japan and China also nicely up this month but down so far in 2025.

Data source : Bloomberg

While tariff threats continue to creep in the shadow, the rather underwhelming reaction from trading partners and the repeated postponements have earned the US President the unflattering acronym “TACO” trade or “Trump always chickens out”. Could investors be giving Trump too little face and discount the potential threat a little too much? We should be safe until the July deadline, but will monitor closely.

In other news, the US April inflation surprised everyone by falling slightly to 2.3% from 2.4%, while GDP growth remained stable at 2.8%. Again, this is quite different from what should have happened under a tariff regime. We also witnessed renewed enthusiasm in US PMI (Purchasing Managers’ Index), up 2 points in both manufacturing and services.

Meanwhile, eurozone inflation also went slightly down to 2.4%, but growth remains unimpressive at 0.3%. The good news is that German growth is finally picking up a bit of steam and staying out of a recession for the time being.

Over in China, growth is lower than we had become accustomed to at 1.2% and inflation is close to 0% and PMI is in neutral territory, therefore, it can be said that they are holding things together quite well in the face of the tit for tat it has going on with the US.

Our summary recommendations

Once again, we used the very short-lived volatility events in our favor to add low-strike products to our clients’ portfolios, with high single digit coupons and protection on the downside in case things turn sour.

Moreover, our prudent positioning in equities, bonds and high allocation to low or decorrelated alternative investments enables us to limit the impact on portfolios and sleep at ease through the various Trump announcements.

Let us see where the tariff negotiations are heading and whether time proves TACO or history right, before we make big changes.

Chart of the month

The chart shows the US consumer sentiment, as measured by the University of Michigan survey. The monthly survey measures US consumer attitudes toward personal finances, business conditions, and economic activity.

The May figure came very close to the all-time low of June 2022, when inflation was very high and interest rates were hiked by the Fed at a fast pace. Even during the worst of Covid, it never reached these levels.

This is one of those times when the sentiment is a poor reflection of the stock market and the discrepancy is evident.

Source: Bloomberg

Disclosures

This document has been issued by Stork Capital, registered with the Swiss Association of Asset Managers, and licensed by FINMA.

Offering Documents. This material is provided at your request for informational purposes only and is not intended as an offer, a solicitation of an offer, to buy, sell or carry out any transaction on investment instruments or other specific product, it only contains selected information with regards to Stork Capital’s services. The analysis and information contained herein do not constitute a personal recommendation or consider the particular investment objectives, investment strategies, financial situation and needs of any specific recipient. Certain services and products are subject to legal restrictions and cannot be offered worldwide on an unrestricted basis and/or may not be eligible for sale to all investors. All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, however, Stork Capital cannot guarantee the accuracy of such content, ensure its completeness, or warrant that such information has not or will not change.

Prior to any investment, prospective investors should carefully read the latest offering documentation, including but not limited to the fund’s prospectus which contains inter alia a comprehensive disclosure of applicable risks. The relevant constitutional and offering documents are available free of charge at Stork Capital’s principal office.

Risk Information and Potential Loss. Financial advisers generally suggest a diversified portfolio of investments. The funds described herein do not represent a diversified investment by themselves. This material does not constitute investment advice and should not be used as the basis for any investment decision. This material does not purport to provide any legal, tax or accounting advice. Prospective investors should consult their financial and tax adviser before investing in order to determine whether an investment would be suitable for them.

Any investor or prospective investor should be aware of the risks inherent in trading activity, such as but not limited to currency risk, interest-rate risk, market risk, insolvency risk, and is aware that trading can be very speculative and may result in losses as well as profits. Therefore, an investor should only invest if he/she has the necessary financial resources to bear a complete loss of this investment.

Portfolio Allocations. This material contains information that pertains to past performance or is the basis for previously-made discretionary investment decisions. The value of investments may fall as well as rise and investors may not get back the amount they invested. Thus, past performance does not necessarily provide any guarantee of future results. Accordingly, this information should not be construed as a current recommendation, research or investment advice. It should not be assumed that any investment decisions shown will prove to be profitable, or that any investment decisions made in the future will be profitable or will equal the performance of investments discussed herein. Any mention of an investment decision is intended only to illustrate our investment approach and/or strategy, and is not indicative of the performance of our strategy as a whole. Any such illustration is not necessarily representative of other investment decisions.

Portfolio holdings and/or allocations shown above are as of the date indicated and may not be representative of future investments. The holdings and/or allocations shown may not represent all of the portfolio's investments. Future investments may or may not be profitable.

Intended Recipients. This material and any information contained therein shall only be for the personal use of the intended recipient and shall not be redistributed to any third party, unless Stork Capital or the source of the relevant market data gives their approval. This material is not directed to any person in any jurisdiction where (on the grounds of that person’s nationality, residence or otherwise) such documents are prohibited. In particular, neither this document nor any copy thereof may be sent, taken into or distributed in the United States or to any US person.

Disclaimer of Endorsement. References in these discussion materials to any specific manager, service provider, vendor, market, index, financial procedure, process, resources, or commercial services do not constitute nor imply its endorsement, recommendation, or favour by Stork Capital. Views and opinions expressed are for informational purposes only and do not constitute a recommendation by Stork Capital to buy, sell, or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change, they should not be construed as investment advice. The website links provided are for your convenience only and are not an endorsement or recommendation by Stork Capital of any of these websites or the products or services offered. Stork Capital is not responsible for the accuracy and validity of the content of these websites.

Investment Risks. Risks vary by the type of investment. For example, investments that involve futures, equity swaps, and other derivatives, as well as non-investment grade securities, give rise to substantial risk and are not available to or suitable for all investors. We have described some of the risks associated with certain investments below and, in certain cases, earlier in this presentation. Additional information regarding risks may be available in the materials provided in connection with specific investments. You should not enter into a transaction or make an investment unless you understand the terms of the transaction or investment and the nature and extent of the associated risks. You should also be satisfied that the investment is appropriate for you in light of your circumstances and financial condition.

Alternative Investments. Private investment funds and hedge funds are subject to less regulation than other types of pooled vehicles. Alternative investments may involve a substantial degree of risk, including the risk of total loss of an investor’s capital and the use of leverage, and therefore may not be appropriate for all investors. Liquidity may be limited. Investors should review the Offering Memorandum, the Subscription Agreement and any other applicable disclosures for risks and potential conflicts of interest. Alternative Investments may be subject to less regulation than other types of pooled investment vehicles such as mutual funds. Alternative Investments may impose significant fees, including incentive fees that are based upon a percentage of the realized and unrealized gains and an individual’s net returns may differ significantly from actual returns. Such fees may offset all or a significant portion of such Alternative Investment’s trading profits. Alternative Investments may not be required to provide periodic pricing or valuation information. Investors may have limited rights with respect to their investments, including limited voting rights and participation in the management of such Alternative Investments.

Real Estate. Investments in real estate involve additional risks not typically associated with other asset classes, such as sensitivities to temporary or permanent reductions in property values for the geographic region(s) represented. Real estate investments (both through public and private markets) are also subject to changes in broader macroeconomic conditions, such as interest rates.

The sole place of jurisdiction for all disputes arising out of or in connection with this material and/or the present disclaimer and/or to the use of this material is Geneva, Switzerland, and it shall be exclusively governed by and construed in accordance with Swiss law.